Well-done to all the readers who correctly identified the mystery company discussed earlier this week was indeed Robert Wiseman Dairies plc. Unfortunately, no prizes are on offer, but with this post I do include a much more detailed analysis of the business.

Robert Wiseman owns and operates seven major milk processing dairies in the United Kingdom and supplies over 30% of the liquid milk consumed within the country, with key customers including supermarkets such as Tesco, J Sainsbury and The Co-operative. The UK milk market has become increasingly concentrated in recent years, with Wisemans, Dairy Crest and Arla turning the market into an oligopoly, as shown in the chart below, which was published in the Wiseman FY10 annual report.

Wiseman has consistently grown volumes and sales over time, as can be seen in the chart below. However, this has come at the cost of margins, suggesting that there is some overcapacity in the industry at present (putting pressure on pricing) or that Wiseman in particular have been bidding aggressively in order to win contracts. The industry is relatively competitive, with Wiseman making net profit of only 2p on each litre of milk processed.

Despite the falling margins, the Wiseman has been able to grow operating free cash flow (defined as operating cash flow less capex) rapidly in the last few years. This has been due to capex gradually declining while operating cash flow has increased, creating a positive “jaws” effect as each move in opposite directions, driving a rapid improvement in operating free cash flow. This can be seen in the chart below. Note that FY10 benefited from a working capital inflow, while FY11 saw an outflow, explaining much of the difference in cash flow between the two years.

Despite the falling margins, the Wiseman has been able to grow operating free cash flow (defined as operating cash flow less capex) rapidly in the last few years. This has been due to capex gradually declining while operating cash flow has increased, creating a positive “jaws” effect as each move in opposite directions, driving a rapid improvement in operating free cash flow. This can be seen in the chart below. Note that FY10 benefited from a working capital inflow, while FY11 saw an outflow, explaining much of the difference in cash flow between the two years.

The company has a strong balance sheet, operating with less than £5m of net debt, no retirement benefit obligations and (as at FY10) no operating leases. The company does however, rely on a negative working balance to fund the business, though historically the cash conversion cycle has been very stable, fluctuating between -19 and -25 days over the last six years. Despite the lack of debt finance and no use of operating leases, the company has been able to consistently generate double-digit returns on equity, as shown in the table below. The one exception was in FY09 due to a particularly high tax charge because of the withdrawal of Industrial Buildings Allowance. Other metrics remained stable during this period.

The key negative surrounding Wiseman at present is the impact of commodity prices. Wiseman purchases its milk in the open market, meaning it is then reliant upon passing through price rises to its supermarket customers. Similarly, the other key input is HDPE resin used in the production of plastic milk containers. Given this is an oil derivative, Wiseman is impacted by changes in the oil price (as it is for its own logistics) and reliant upon the timely pass-through of these costs. In the FY11 annual results release, management noted that recent rises in input prices would impact the cost base by £7.5m on an annualised basis. Assuming no pass-through of these price rises to customers (and that volumes remain the same), Wiseman’s profits would fall from £27.2m in FY11 to £21m in FY12 (also assuming the tax rate normalises to the UK statutory rate of 25%). This would be equivalent to 29.9p per diluted share. However, I would expect them to achieve some level of volume growth and some level of price pass-through, suggesting this should be the low-end of earnings estimates.

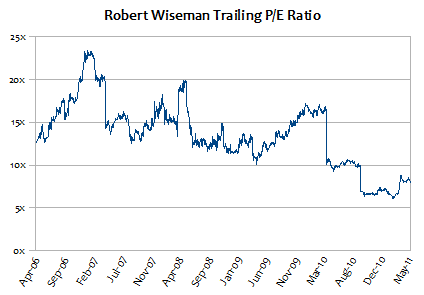

It could be argued that this challenging outlook is fully-reflected within the Wiseman share price, which is currently 314.9p and implies a forward price/earnings ratio of 10.5x (using my bear case estimate of 29.9p). As the chart below shows, the company has been significantly de-rated over the course of the last six years, and today trades very close to it’s six-year low in valuation terms. (Note the trailing earnings in FY09 have been adjusted for the one-off tax charge).

This looks reasonably attractive price for a business that operates in an oligopolistic market, earns high returns on equity, has little debt and has a good rate of cash conversion. Wiseman looks attractively valued on other metrics too; EV/FY12E EBITDA is a tiny 4.1x, while the business offers a high prospective free cash flow yield of 10.5%. Assuming the board keeps the same dividend in FY12 as the company paid in FY11 (18p), the yield will be a chunky 5.7%. In addition, the company has a history of repurchasing shares, having reduced the count from 74.7m in FY06 to 70.4m in FY11. The company does trade at a premium to book value (1.22x), though arguably this is justified given the return on equity (6yr average of 17.3% excluding the one-off tax charge). Valuing the company using the dividend discount model with a cost of equity of 11%, the current share price assumes a relatively undemanding 2.5% per annum earnings growth for the next five years (using my low-ball FY12E 29.9p EPS estimate as a base), with the dividend pay-out ratio increasing from 62% to 67%, and then terminal growth of 1.25% per annum. Given FY12E could well be a one-off “bad year” due to the commodity price inflation, there is ample scope for this estimate to be exceeded if earnings normalise.

One other factor I tend to look at when analysing businesses for the purpose of investment is the company’s debt capacity. Given that Wiseman has earned relatively stable and growing EBITDA over the last six years, operates in a non-cyclical industry, has a market share of >30% and has a balance sheet rich in fixed assets, if I were a lender I would feel relatively comfortable with Wiseman. If the balance sheet was leveraged 1.25-1.5x EBITDA, Wiseman would be able to pay-out £77-92m to shareholders upfront (34-41% of market capitalisation), while incurring interest costs of £5-6m per annum assuming an interest rate of 6.5% (giving EBITDA interest cover of 10.2-12.3x). However, with the Wiseman family owning 32% of the company’s shares, I see such a recapitalisation as very unlikely.

Even though most of the bad news about near-term earnings and the competitive nature of the market, it is hard to see how returns could significantly exceed high the 11% cost of equity used in my dividend discount model without management taking steps to leverage the balance sheet. Given their blocking-stake in the company, it is unlikely an outsider could possibly force them to do so. That said, I see the downside as relatively limited. Barring a major management screw-up or the outbreak of a price war (which would be utterly crazy in a market controlled by three companies), I also struggle to see what could go wrong for Robert Wiseman.

Disclosure: No position.

Update: See this post on Robert Wiseman by Mark Carter and this post by Philip O’Sullivan which briefly discusses Irish comparable Glanbia plc.

Calum

08/06/2011

interesting post. what are your thoughts on dairy crest?

you might get some interesting information about the industry from dairy uk (industry body) and the recent inquiry into eu proposals for the dairy industry by DEFRA here: http://www.parliament.uk/business/committees/committees-a-z/commons-select/environment-food-and-rural-affairs-committee/inquiries/dairy-industry/ Robert Wiseman are giving evidence today.

cautiousbull

11/06/2011

To me, Dairycrest looks a lot more expensive than Robert Wiseman, with an EV/EBITDA ratio of 6.5x (vs 4.1x), dividend yield of 5% (vs 5.7%), and has an equity free cash flow yield of 8.2% (vs 10.5%). If I was going to buy either one, I’d probably go for the cheaper one given the relatively undifferentiated products.

arun

23/06/2011

Robert Wiseman Dairy Crest

Market Cap 221m Market cap 489m

PTBV 1.41 PTBV – 2.10

ROCE 19.1 ROCE 34.8

Margin 4.01% Margin 5.69%

Cash flow /EPS 1.9 Cashflow/ EPS 3.74

Milk Turnover 100% Milk Turnover 67%

Spreads Turnover 17%

Cheese Turnover 16%

I have invested in both companies but Dairy Crest will out perform Robertwiseman.

Mark H

26/06/2011

Have just come across your blog site. Really good reading/analysis. I also invest based upon the value principles.

For me the advantages and disadvantages of RWD are;

Adv

*Strong balance sheet

*Strong management

*The boards interests aligned with that of shareholders (% holdings)

*Good market share.

*Milk will always be required

*Growing population

*Probably the most modern and efficient processing plants in the country.

Dis Adv

*Lack of diversity in both product offerings (mainly milk and small amount of cream sales, but also geographical presencese when compared to competitors.

*Powerful clients dictate terms and pricing to an unhealthy level (Tesco etc).

*Supermarket price wars, have tended to use milk as a headline grabber, meaning sales pricing is always under threat.

*Margins based on commodity markets (Milk & Oil)

*Risk of milk scare (i.e e-coli outbreak) that would hit the business severely if it ever happened.

I have had RDW on my watch list for many months, and whilst the share price currently looks cheap, the fundamentals do not quite tell the full story. If the price dropped into the 280-290 region I would be more likely to take an investment. As I think over the medium to longer term there is good potential upturn.

Francesco Miscio

28/06/2011

Would you share some of your experience and provide more insight about RWD, short and long run average total costs. In particular I am interested in your opinion regarding variabilisation as a mean to improve their assets burden

cautiousbull

04/07/2011

Short and long-run average total are not possible to calculate as external observers of a company, and arguably very difficult to calculate even for corporate insiders given the complex range of assumptions that have to be made. As for cost variabilisation, Robert Wiseman doesn’t provide a breakdown of their costs between various expense categories, so we do not know the cost split between fixed:variable.

arun

06/07/2011

Price will go up in the next few weeks. 18.0p final dividend payable on 15 September 2011 to shareholders on the register at close of business on 5 August 2011